Sergio Cecutta, partner at SMG Consulting discusses how he is judging the companies most likely to win the race to bring the world’s first eVTOL to market.

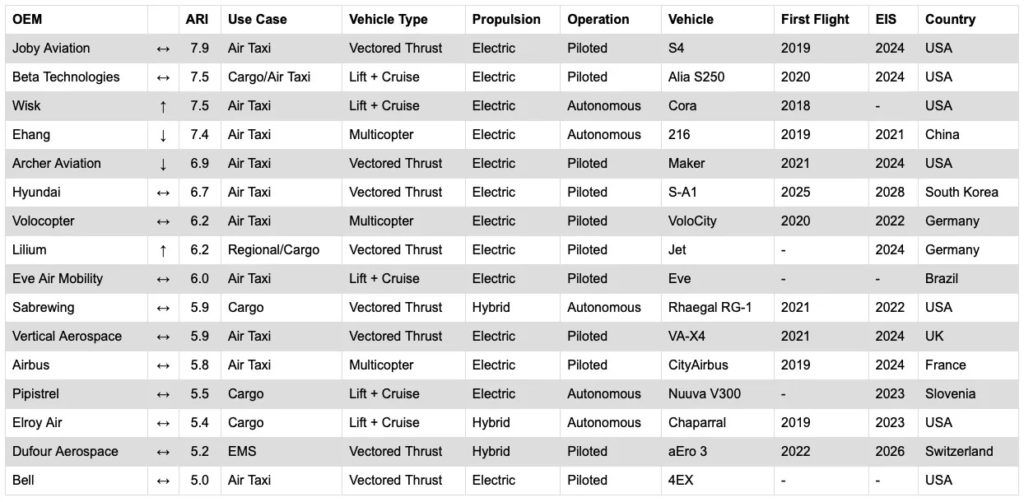

At the beginning of the year SMG Consulting launched its Advanced Air Mobility Reality Index to monitor the progress of the aerospace companies developing eVTOL aircraft.

The AAM Index does this by judging how likely it is an OEM will be able to certify their aircraft, that the aircraft enters service and is produced in the quantities specified by the company, usually thousands of units per year.

SMG Consulting’s May AAM Reality Index (click for larger)Sergio Cecutta, partner at SMG Consulting says the reality index began life as an internal tool and has matured into a way to assess the likelihood of AAM programs succeeding.

He says, “We use parameters for assessing the progress on the vehicle side. We ask questions like – has a full-scale aircraft flown? Have they tested the whole performance envelope? Are they talking to regulators about certification?

“The majority in the top 10 are doing full-scale testing.”

Cecutta has background in aerospace engineering as well as a MBA and before founding SMG Consulting in 2012 worked for Honeywell and Danaher. SMG has expanded during the last ten years into a network of experts across the world, who work with aerospace companies on aspects of developing new aircraft such as airworthiness, flight testing, avionics and flight controls.

“We are engineers as well as business people. It’s important for the leaders of aerospace companies to be able to ‘speak’ and understand engineering,” says Cecutta. “

The company has been involved in eVTOL aircraft since 2017 and bills itself as an active participant in the advanced air mobility (AAM) market and works with the Vertical Flight Society, GAMA, NASA, US Air Force, FAA and EASA.

Progression to market

The index is made up of 16 companies and will be expanded and revised periodically. Each company is scored from zero to ten, zero being a company considering developing a market and ten being one which has a commercial product being mass produced.

Crucial to understanding the index is that it is not an assessment of technical merit. Cecutta explains, “We purposefully try to produce something simple. We don’t look at the performance. You need to be an insider or on a program to judge that.

“Instead, the index highlights who is going to make it to the end point of having a product. It considers what the likelihood is of an OEM being able to develop and certify the vehicle.

“We monitor the market and move companies up and down according to the progress against our parameters.”

Scoring system

The ARI score is based on five main factors: the funding received by the company, the team that leads the company, the technology readiness of the vehicle, the certification progress of the vehicle and the production readiness towards full scale manufacturing.

Detailed analysis of each of these areas produces the score. For example an important part of the reality index’s assessment of certification accounts for the configuration of the eVTOL aircraft.

In assessing the configuration SMG divides vehicles into three types: multirotor, lift plus cruise and vectored thrust. “Vectored thrust is more complex than lift and cruise and both are more complex than multi-rotor,” says Cecutta.

Further analysis of the data also reveals some interesting trends. The highest concentration of AAM programs is found in the USA, where seven out of the 16 are located, the next is Europe and finally Asia.

The index also differentiates between passenger and cargo eVTOLs. However, Cecutta does not believe cargo eVTOL aircraft will be commercialized ahead of passenger ones.

He says, “We think cargo and passenger will probably come to the market at the same time. But cargo will grow at a faster initially, before passenger eVTOLs catch up.”

For more information on the reality index and the latest version go here.