by Jack Roper

Aviation’s contribution to global CO2 emissions is projected to rise from 2.5% to 25% by 2050 as other sectors decarbonize. The easiest way to decarbonize aviation is to stop flying. Continuing operations at current levels requires new fuels which do not emit CO2. Sustainable aviation fuels offer a bridge for existing fleets, but are expensive, production-limited and still produce CO2 which stays in the atmosphere for centuries.

By contrast, hydrogen is carbon-free and beats kerosene for gravimetric efficiency, the energy-to-weight ratio crucial in aerospace. The feasibility of hydrogen powered aircraft was validated by FlyZero, a research program run by the UK Government-funded Aerospace Technology Institute (ATI) which published its conclusions earlier this year.

“FlyZero presented physics-based models of three study aircraft of increasing size and range,” explains FlyZero chief propulsion engineer, Simon Webb. “It found a hydrogen-powered mid-size aircraft carrying 280 passengers could travel anywhere in the world with one refueling stop. That changed industry perceptions of hydrogen as a future net-zero fuel.”

Hydrogen-powered aircraft will require fuel cell or adapted turbine-based powertrains, cryogenic tanks and hydrogen infrastructure at airports. Webb advocates for a UK Centre of Excellence to accelerate innovation.

Airbus is leading development of hydrogen-powered aircraft and is adapting its A380 MSN001 test aircraft to be its demonstrator for its ZEROe program.

“Imagine it as a flying hydrogen laboratory,” says Airbus’ head of ZEROe demonstrators and tests, Mathias Andriamisaina. “Without seats, the A380 test aircraft gives us the entire main and upper decks to conduct tests. We will fit a fifth engine that burns hydrogen in a stub above the fuselage. Inside, we will install four cryogenic tanks within a non-pressurized bubble and hydrogen distribution and evaporation systems.”

The aircraft will still use conventional engines for propulsion but provide a flight environment to test hydrogen systems. But Airbus is not betting everything on hydrogen combustion and is exploring other concepts in parallel. It considers sustainable aviation fuel crucial to decarbonize current fleets.

“Retrofitting an airliner with hydrogen engines is not a viable way to serve airlines,” says Andriamisaina. “An aircraft with low maintenance and operating costs with hydrogen propulsion must start from a clean-sheet design with freedom to play with the locations of tanks and passengers.”

This blank page affords consideration of blended-wing airframes or distributing six detachable pods, each a self-contained propulsion system with hydrogen tanks, fuel cells, electric motors and an eight-blade propeller across an aircraft’s wings.

“We are considering many concepts in parallel,” Andriamisaina explains. “The advantage of pods would be ease of operation. An independent propulsion system with few aircraft interactions allows parallel refueling and interchangeability of assemblies for maintenance.”

Starting small

Airbus aspires to create a 200-seat, 2300 mile (3,700km) range hydrogen combustion airliner, having marketed a 100-seat, 1,150 mile (1,850km) range first product by 2035.

But startups H2FLY and ZeroAvia are developing smaller aircraft powered by fuel cells to much shorter timescales. In 2020, ZeroAvia successfully flew a six seater Piper Malibu with a 250kW hydrogen-electric propulsion system and is poised to test a 600kW-equipped, 19-seater Dornier 228.

“We removed the left hand engine and retrofitted a hydrogen-electric powertrain,” says ZeroAvia’s head of aircraft integration and testing, Gabriele Teofili. “It consists of hydrogen tanks, fuel cells and electric propulsion. The righthand engine and batteries provide dual redundancy.”

ZeroAvia aims to certify its 600kW powertrain so it can be used in 9 to 19 seat aircraft by 2025 – the same timescale within which H2FLY expects to start operations with its 300kW five-seater aircraft. H2FLY’s aircraft will use technologies proven on the company’s HY4 hydrogen-retrofitted Pipistrel Taurus G4 glider, first developed at the German Aerospace Centre (see last issue).

“The HY4’s architecture accommodates weight on the middle wing,” says H2FLY’s CEO, Josef Kallo. “That allows volumetric and gravimetric freedom to focus on the powertrain, redundancy and the ability to qualify.”

In parallel, both H2FLY and ZeroAvia are working on upscaled 2MW powertrains.

“ZeroAvia believes in flight testing,” says Teofili. “We have a plan, an aircraft and a capability to learn by doing – and sometimes failing – to accelerate understanding and integration of technology.”

Race for knowledge

Airbus will gather knowledge through stepping stone experiments with smaller aircraft. The Blue Condor project will see Airbus and not-for-profit organization the Perlan Project retrofit hydrogen combustion to the Arcus-J sailplane used to break the glider altitude world record. But ultimately developing a hydrogen-fueled airliner is a longer-haul endeavor.

“We cannot compete with the time frames of companies retrofitting existing airframes with current technologies to create 19-seater aircraft with modest ranges,” says Andriamisaina. “Our business is different. But we would love to see these aircraft flying and proving hydrogen’s feasibility at airports.”

Liquid hydrogen requires 80% less fuel tank space than gaseous to deliver the same energy because of its reduced volume. As a consequence, Airbus believes only liquid hydrogen will be suitable for powerful, intercontinental aircraft, and this means the development of on-board cryogenic systems.

“We must store liquid hydrogen below -253°C (-423˚F) for twelve hours or more,” Andriamisaina explains. “We want a fully passive system, without freezers or compressors, to optimize storage capacity against system mass. Airbus has launched Zero-Emission Development Centers (ZEDCs) in France, Germany, UK and Spain to create in-house capability for insulated, safe and reliable cryogenic storage and distribution.”

Cryogenic technology predominantly used for chemical ground storage must be integrated with aircraft. Besides tanks, aircraft will need cryogenic leak-detection, distribution and evaporation systems. Space industry experience of cryogenic fluids is relevant, but while rockets burn briefly and intensely, an airliner’s cryogenic pumps will have to serve 10,000 hour working lifetimes.

Test requirements

ZeroAvia and H2FLY have flown demonstrators with pressurized gaseous hydrogen without complex thermal management. But both recognize the need to adopt liquid fuel to support scalability and increased range. Once flight-proven, ZeroAvia’s Dornier will become a testbed for cryogenic systems. H2FLY is ground-testing its HY4 with liquid hydrogen storage developed by industrial gas supplier Air Liquide. The transition to hydrogen is asking new questions of aerospace testing.

“Conventionally, we have analyzed and took materials to failure in physical tests,” says Element’s market technology director for renewables and hydrogen, Mark Eldridge.

“Now, we can digitally engineer the solutions. We are working on the whole end-to-end problem, from aircraft systems to pipes and hydrogen infrastructures.

“We can model the feasibility of what someone wants to do and the facilities needed to support that.”

the first aircraft to fly fueled by liquid hydrogen

(Photos: H2FLY)

Elridge believes that in order to meet urgent decarbonization time frames, the aerospace sector must adopt new collaboration models and that there must be an emphasis on digital simulation and reduced physical testing for validation. The desired endpoint must be pragmatically considered in relation to the technology available today and the two joined in the middle. How aircraft systems interact with hydrogen must be fully understood.

“The components are material, pressure and temperature,” says Eldridge. “How do alloys, composites, plastics and ceramics behave around both liquid and gaseous hydrogen?

“Hydrogen is a small molecule. Like sand it gets everywhere and permeates through materials such as metallics and composites. Material properties change when subjected to different combinations of pressure and low temperature, so tests must follow the aircraft’s lifecycle.”

Webb sees a need for research on non-CO2 emissions and leakage detection. He expects validation to proceed from specimen material tests focused on cryogenic hydrogen compatibility, through component and fuel system tests to full-scale powertrain tests.

“We may stand up several UK facilities to drive a demand signal,” says Webb. “Firstly, for gaseous and then once we get into fuel and thermal systems, for liquid hydrogen.”

Rolls Royce is already conducting gaseous hydrogen combustion and injection testing at Loughborough University and planning to test an engine at Boscombe Down’ in the UK. Airbus will conduct hydrogen fuel system and component testing at Filton, Bristol. UK-based engineering company Filton Systems Engineering is producing liquid hydrogen at Cotswold Airport, Gloucestershire – also home to ZeroAvia’s test-hangar.

“Outside the hangar, an electrolyzer produces hydrogen for our ground-tests and flights,” says Teofili. “Inside are three system test laboratories where we test powertrain elements – the engine and inverter – the fuel cell with tanks and thermal management. We have software laboratories and the aircraft itself, where we integrate systems and conduct ground-tests.”

ZeroAvia is building all of the facilities required for development and certification testing of subsystems and iron-bird or copper-bird full-system tests, but the company’s rapid growth makes recruiting enough suitably qualified engineers a challenge. Teofili anticipates UK partnerships will be arranged to support environmental temperature and vibration tests. Investigations into hydrogen-generated contrails will also be needed.

“A fuel cell or hydrogen turbine produces no particulate matter, but three times as much water as kerosene,” says Webb. “There’s a risk that could worsen climate impact from contrail-formation in ice-supersaturated regions.”

Post-FlyZero, the ATI plans workshops with university teams to establish what research could usefully reduce uncertainty around NOx and contrail effects from hydrogen propulsion. There could even be potential benefits.

“At night, contrails reflect back surface energy and have a warming effect,” Webb explains. “But by day, they reflect solar energy back up. Perhaps deliberately creating contrails at certain times could have a net-positive cooling effect. That would represent a radically changed position for aviation.”

Fuel cells vs turbines

Hydrogen can provide energy to propel aircraft either in fuel cells powering electric motors or by combustion in adapted gas turbine engines.

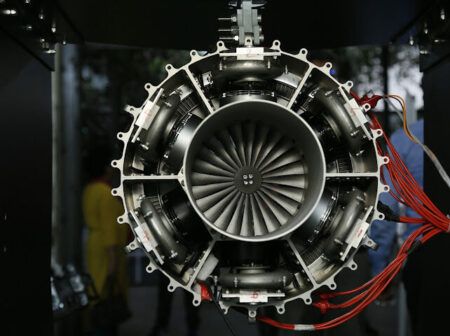

“Externally, a hydrogen turbine would resemble a conventional one,’ says FlyZero chief propulsion engineer, Simon Webb. “But a heat exchanger would add thermal energy to evaporate cryogenic hydrogen ready for combustion. Instead of spray nozzles to atomize liquid fuel, it would use a multi-point injection system.”

While fuel cells with electric motors have successfully powered short-range light aircraft, consensus favors hydrogen turbines for large intercontinental airliners. Of FlyZero’s three study aircraft, only the smallest employs fuel cells for propulsion, while the larger two combust hydrogen.

“Gas turbines are more power-dense,” Webb explains. “For powerful, longer-range aircraft, fuel cells become too heavy. Gas turbine technology is also comparatively more mature.”

Though fuel cells only heat to around 100°C (212˚F), they require cooling systems which add further weight, whereas turbines are self-ventilating. But at more than 1000°c (2,120˚F) combustion-chamber temperatures mean hydrogen turbines would generate NOx from ambient nitrogen, while fuel cells are a low noise solution and emit only water.

ZeroAvia disavows combustion as a compromise which still delivers pollution. While it concedes that fuel cells cannot currently support an A320, it believes future developments may enable them to.

Airbus remains open-minded but considers turbines the most feasible option for aircraft that seat around 200 passengers with a range of around 2,000 miles (3,200km) by today’s reckoning.

Rolls-Royce is ground-testing hydrogen engines it hopes will power narrow-body aircraft by the mid-2030s.

“Modifying core systems to combust hydrogen should be achievable,” says Mathias Andriamisaina of Airbus. “But in radically changing aircraft design, we want to achieve full zero and believe a low-NOx combustion chamber is feasible by 2035.”

Building a hydrogen infrastructure

Hydrogen aircraft will require ground-based infrastructure and a global hydrogen supply absent today. Airbus has joined the Hy24 managed hydrogen infrastructure fund and created an ecosystem team to develop physical and regulatory frameworks.

“We need new partners to modify the airport environment,” says Airbus ZEROe’s Mathias Andriamisaina. “We are pushing the concept of airport hydrogen hubs. Producing and storing hydrogen in common for several applications, not only aircraft, could allow cross-sector synergies and allow shared development costs.”

Airbus will work with Aéroports de Paris on hydrogen infrastructure. H2FLY conducted its latest flight campaign at Stuttgart Airport to demonstrate integration with international operations. According to Element’s Mark Eldridge, today’s global hydrogen liquefaction capacity might only meet the demand from hydrogen-powered aviation at a single small airport. The UK for example imports liquid hydrogen in tankers due to an absence of domestic production.

“It is the chicken-or-egg problem for aerospace,” says Eldridge. “We need liquid hydrogen to advance aerospace development. But without a demand pull from aviation, there is no business case for anyone to build those liquefaction facilities. The best way to break that cycle is to learn by doing – you build scalable demonstrators to create investment cases.”

Eldridge applauds the demonstration first approach of ZeroAvia and H2FLY in creating pockets of activity where wider development can germinate. “It could lead to a hydrogen demonstration airport for investors somewhere in the UK, then the ecosystem grows from there,” he says. “Equally, if more billionaires committed to net-zero aviation, their companies’ share prices would increase overnight and we could get there much faster.”