Honeywell is to separate out its aerospace technology division into an independent company during the second half of 2026.

The planned separation is part of a major restructuring that will create three separate publicly traded companies from the USA, Charlotte-based corporation.

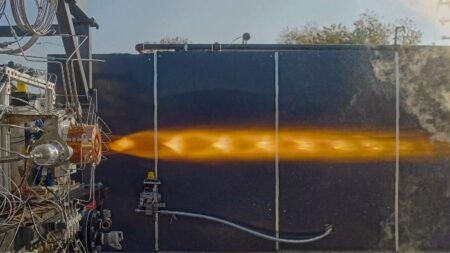

The aerospace business, which generated US$15 billion in annual revenue last year, produces technology and systems used on almost every commercial and defense aircraft platform worldwide. The company manufactures aircraft propulsion, cockpit and navigation systems, and auxiliary power systems.

“As Aerospace prepares for unprecedented demand in the years ahead across both commercial and defense markets, now is the right time for the business to begin its own journey as a standalone, public company,” said Vimal Kapur, Chairman and Chief Executive Officer of Honeywell.

“Today’s announcement is the culmination of more than a century of innovation and investment in leading technologies from Honeywell Aerospace that have revolutionized the aviation industry several times over. This next step will further enable the business to continue to lead the future of aviation.”

The new aerospace company is set to become one of the largest publicly traded aerospace suppliers globally. The business aims to advance the electrification of aircraft systems and develop autonomous flight capabilities.

The aerospace separation forms part of a wider corporate restructuring. Honeywell will divide into three separate companies through the split of its current operations.

The second company, Honeywell Automation, will focus on industrial automation and control systems, with revenues of $18 billion. The third company, Advanced Materials, will manufacture specialty chemicals and materials, with revenues of $4 billion.

The company expects to complete the Advanced Materials separation by early 2026, followed by the Aerospace and Automation split in the second half of 2026.

In addition Honeywell said it plans to continue to enhance its portfolio through acquisitions. Since December 2023, the company has acquired several businesses including Civitanavi Systems and CAES Systems to strengthen its aerospace capabilities.

The split requires regulatory approval and confirmation of tax-free status for shareholders and will occur through a tax-free distribution of Honeywell Aerospace shares to current Honeywell shareholders.