Airbus is to reduce the number of engineers working on hydrogen R&D globally but will keep critical technology projects related to fuel cells and cryogenic systems running.

Instead, the European planemaker’s R&D strategy will prioritize work on sustainable aviation fuel (SAF) and “other innovations” as the main way to reduce aircraft emissions before hydrogen is commercially viable, said Guillaume Faury, CEO of Airbus at the company’s 2024 financial results this week.

The delay and scaling back of its hydrogen R&D activities was trailed following an announcement it is pausing its CityAirbus NextGen eVTOL aircraft testing program in the weeks leading up to the release of Airbus’ financial results yesterday.

Airbus’ ZEROe program, which was launched in 2020 aimed to put a hydrogen-propulsion aircraft into service by 2035. The company has now delayed that by up to ten years and canceled plans to flight test hydrogen propulsion systems on a modified A380 this decade.

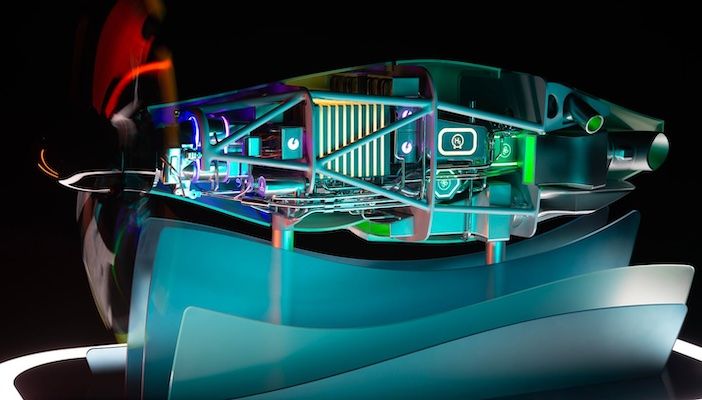

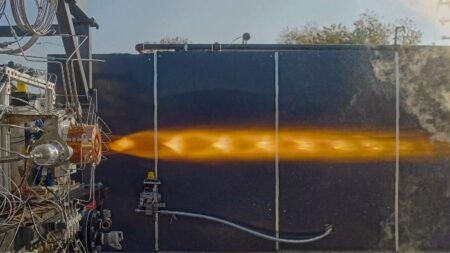

Airbus also has several Zero Emission Development Centres throughout Europe, which are developing and testing hydrogen-related systems and technologies, such as fuel cells and cryogenic fuel systems.

Faury said, “Our ZEROe project remains central to decarbonization plans. We are adjusting the roadmap, but we are not moving away from hydrogen. It is and remains front and center of the strategy.

“Hydrogen R&D will continue. Globally the workforce will be smaller.”

“Work on the critical technologies will continue at full speed – fuel cell and cryogenic work will accelerate. But we will go slower on the ecosystem because that part is not moving at the pace we thought it would.”

While emphasizing that a hydrogen fuel cell powertrain is technically feasible and the best way to achieve zero-emissions commercial passenger aircraft, Faury blamed the lack of progress in establishing hydrogen fuel infrastructure as the main reason for scaling back R&D.

“We need to develop a commercially viable product. That will depend on the regulatory work and the development of a hydrogen ecosystem around the world where we want to use the aircraft.”

“There needs to be a sufficient supply of hydrogen at airports.”

Faury also admitted that an eventual hydrogen fuel cell powered aircraft could look different from the ZEROe concepts publicized during the last five years. “The aircraft has to make sense in terms of size, range and passenger capacity for between 2035 and 2045. We have to look at the complete equation,” he said.

CityAirbus eVTOL pause

Faury also explained the similar logic behind why its eVTOL program, the CityAirbus NextGen has been put on hold during the financial results presentation: “We approached eVTOL R&D with prudence. We need a commercially viable product and clarity on the regulatory framework,” he said.

“The conditions for a viable product are not there. We see that with the other players too. The speed of improvement of battery energy density is not fast enough. It will come later. We also need to understand the acceptability of eVTOL in dense urban environments. Electricity in general aviation is a market, but one in which Airbus does not want to play.”

Faury added that technology developed for the CityAirbus would be used in its helicopters and commercial aircraft.

Supply chain challenges persist

Elsewhere in the 2024 financial report, Airbus, currently the world’s largest aerospace manufacturer, said it aims to make 820 aircraft this year – 7% more than the 766 planes it made last year.

During the presentation, Faury described 2024 as “a colorful year” and reported an 8% drop in income after various charges, including losses in its Space business. Faury confirmed that Airbus is involved in discussions about a merger of European space businesses. “We continue to explore strategic opportunities with Leonardo and Thales,” he said.

Faury said Airbus is on track with a manufacturing ramp-up of the A320, while production of the A350 and the A220 continues to be disrupted by supply chain challenges, mainly because of Spirit AeroSystems. Spirit is currently being broken up and sold, with the different parts relevant to their respective supply chains being bought by Boeing and Airbus.

In addition, Airbus has delayed a freighter version of the A350 aircraft by a year to the second half of 2027 and reported charges for more delays to the A400M military transport plane.