Parker Hannifin is to acquire Lord Corporation for approximately US$3.675 billion.

The transaction has been approved by the directors of each company and is subject to closing conditions, including regulatory approval.

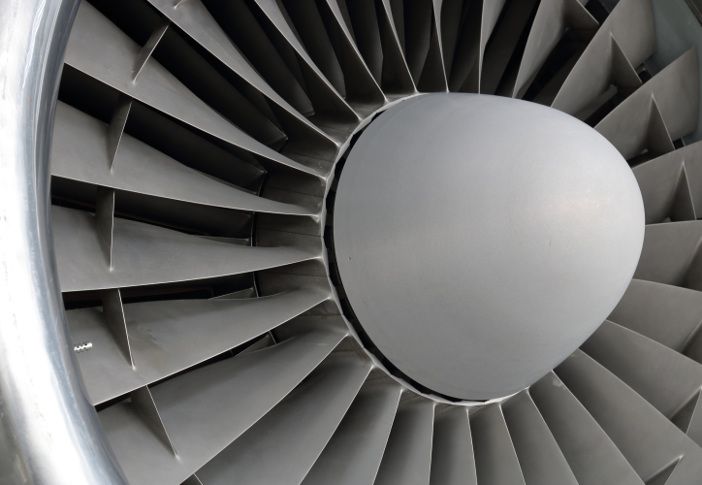

Lord, which is headquartered in Cary, North Carolina, offers a broad array of advanced adhesives, coatings and specialty materials as well as vibration and motion control technologies to the aerospace sector.

The company has annual sales of around US$1.1 billion and has around 3,100 team members at 32 sites globally.

Tom Williams, chairman and CEO of Parker Hannifan said, “This transaction will reinforce our objective to invest in attractive margin, growth businesses that accelerate us towards top-quartile financial performance.

“Lord will significantly expand our materials science capabilities with complementary products, better positioning us to serve customers in growth industries and capitalize on emerging trends such as electrification and lightweighting.

Ed Auslander, president and CEO of Lord said, “With complementary business segments, coming together with Parker will enables is to carry out our grander vision. Parker is already a large tier one supplier in many areas, allowing our business lines immediate access to growth, additional markets, applications and new customers. In addition, the two companies are very much aligned when it comes to core values, great business acumen and cultural fit.”