Virgin Orbit is filing for bankruptcy in the USA after axing 85% of its workforce.

The space launch provider has suffered a rapid demise after a planned space launch from Cornwall in the UK during January this year went wrong. Subsequent investigations by Virgin Orbit engineers identified the cause of the failure to be a fuel filter that became dislodged, causing temperature increases and an engine shut-off early during the firing of the rocket’s second stage.

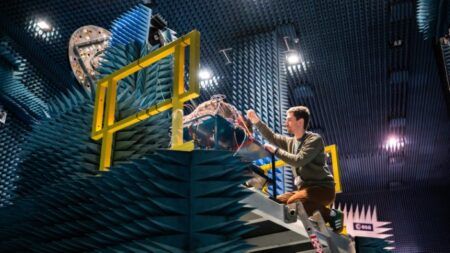

Virgin Orbit’s LauncherOne is an air-launch system, which uses a large aircraft to carry a rocket to a high altitude before launch. The 70ft long, 57,000 lbs (25,800kg) rocket is designed to travel at speeds of up to 20 times the speed of sound (17,000mph) and carry small communications and weather satellites of up to 660 lbs (300kg) into orbit.

The mobile LauncherOne system had conducted several successful launches, as well as a failed launch since its first flight in May 2020.

The bankruptcy filing has been blamed by the company on an “inability to raise sufficient capital to continue operating its business at the current run rate”.

The 85% headcount reduction has left around 100 employees out of around 800 working at what remains of the California-based firm while it sells its assets under Chapter 11 rules in the USA. Virgin Orbit said it is focused on a “swift conclusion” to its sale process.

Dan Hart, CEO of Virgin Orbit said, “The team at Virgin Orbit has developed and brought into operation a new and innovative method of launching satellites into orbit, introducing new technology and managing great challenges and great risks along the way as we proved the system and performed several successful space flights – including successfully launching 33 satellites into their precise orbit.

“While we have taken great efforts to address our financial position and secure additional financing, we ultimately must do what is best for the business. We believe that the cutting-edge launch technology that this team has created will have wide appeal to buyers as we continue in the process to sell the company. At this stage, we believe that the Chapter 11 process represents the best path forward to identify and finalize an efficient and value-maximizing sale.”

Virgin Investments Limited is committing US$31.6 million in debtor-in-possession (DIP) financing to help fund the process and protect its operations. Upon approval from the Bankruptcy Court, the DIP financing is expected to provide Virgin Orbit with the necessary liquidity to continue operating while it sells the business and its assets.

Virgin Orbit has filed customary motions requesting that the Bankruptcy Court authorize funds for the ongoing payment of wages to the remaining employees as well as to its suppliers and vendors. The company said it also paying US$10.9 million to fund severance and benefits for departing employees.

In a statement Virgin Group said, “Whilst Virgin Orbit will not have made this decision lightly, we believe this definitive action puts Virgin Orbit in the best possible place to maximize value and positions the company and technology for future opportunities and missions.”

“Richard Branson and the Virgin Group have supported Virgin Orbit over the long term, investing more than $1 billion in the Company, including US$60 million since November 2022. However, this significant funding was not enough to counter the strong headwinds and liquidity challenges Virgin Orbit continues to face.”