by David Latimer, CEO of Magnomatics

Whilst many may feel that urban air mobility is the stuff of science fiction, the reality is that it is coming and not just in the form small drones for the delivery of packages by the like of Amazon. It is also for the transport of people.

Established industry leaders, such as Boeing, Airbus, Embraer, Bell, Sikorsky and Rolls-Royce, are all are involved in programs to product prototypes and demonstrators. Many are also aligning themselves with some of the well-funded start-ups who may well be the real trailblazers in this sector.

In many respects, this is similar to the early days of electric vehicles. Whilst the traditional players do have electric programs, they also have huge assets in place to manufacture and support traditional aircraft, which brings some inertia, as well as pressure to use low emission fuels, such as green hydrogen or biofuels, and sweat current assets longer.

Market outlook

There are several very well-funded startups that could become the “Tesla” of the air mobility world. These startups are much more focused on delivery of a single objective, getting into service and generating revenue.

A great example of a well-funded start-up is Joby Aviation. They have raised US$820 million from credible investors including Toyota.

Joby is developing a multi-tilt rotor four-seater with a range of up to 240km (150mph). It has completed over 1,000 test flights and is now working on certification with the FAA. Recently, Joby joined forces with Uber and plan to be operational with an air taxi service in 2024.

Meanwhile Ehang, the Chinese air taxi company has a market value of US$1.4bn. In November 2020, in Seoul, Korea, they demonstrated their two-man aircraft with a 3.6km (2 mile) journey using an 80kg bag of rice in place of a person.

However, one of the more promising companies in Europe is Germany-based Lilium, which has raised US$375m. Their full-size tilt wing five-seater prototype first flew on the 4th March 2019. They too are now working on certification and expect to take a public listing very soon. Other credible players include Volocopter (Germany), Dufour (Switzerland), Kitty Hawk (USA and linked with Boeing), Vertical Aerospace (UK) and Archer (USA).

For most of these start-ups the business model is similar. The concept is to use these eVTOL aircraft for short to medium journeys between places like Heathrow and central London, reducing journey times for a small price premium.

Target consumers are those who consider their time to be of great value. Joby use the example of flying from Los Angeles Airport (LAX) to Newport Beach, cutting the journey time from 75 minutes to just 15 . The ticket price maybe a multiple of that for a car but for the cash rich, time poor, this is not a problem.

We can see that urban air mobility is far from a science fiction dream, but just how big could this market become? Consultancy Morgan Stanley optimistically forecasts 49,429 such aircraft by 2025, rising to more than 170,000 by 2040.

Whilst the bulk of these will be small drones for package delivery, a significant proportion will transport people. This is the sector my company Magnomatics is targeting as several new technologies are required to hit the journey price point.

eVTOL innovation

As well as advanced batteries, lightweight and reliable motors are a key enabling technology for these aircraft.

Magnetically geared motors are a technology that has been identified by NASA as ideal for air mobility. The Magnomatics Pseudo Direct Drive (PDD) is just that, the combination of a magnetic gear and a permanent magnet motor.

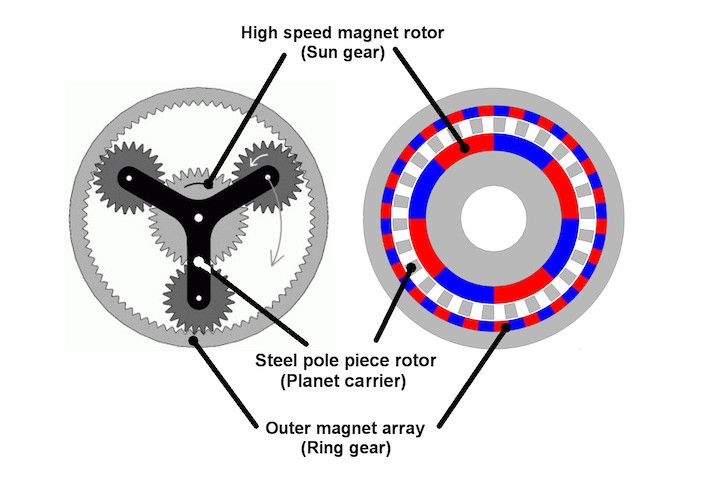

A Magnomatics’ magnetic gear is made up of three elements, inner and outer cylindrical rotors made of an array of magnets with different numbers of poles. Between these two rotors a “pole piece rotor” (PPR) is inserted, the novel component of a magnetic gear.

The PPR provides a flux path link to the inner and outer rotors. This means they rotate synchronously but at different speeds. The magnetic gear behaves just like a planetary gear, with the outer magnets being the ring gear, the PPR as the planet and the inner magnet array as the sun gear.

In a PDD a magnetic gear is mounted inside a wound stator. The flux generated by this stator is used to drive the inner rotor of the magnetic gear. The outer array of magnets are mounted on the inside bore of the stator – the PPR is the output shaft of the PDD.

The PDD has all the benefits of a mechanically geared motor without the reliability and maintenance issues associated with a mechanical gearbox. In other sectors Magnomatics have deployed magnetic gears in hostile environments such as in oil and gas applications. Here they have run continuously for over two years.

Magnomatics see torque density as being the key metric for this market as well as reliability, which has led to them having already received enquiries from a number of serious industry leaders.

Magnomatics have reviewed competing motors being promoted for this sector. All of them use traditional metal structures. The leading example appears to be the Rolls-Royce P200 with a torque density of 30Nm/kg.

However, like others this machine is liquid cooled which introduces further mass, complexity and sources of failure. Magnomatics have made an initial concept design that achieves 32.9Nm/kg but that is as an air-cooled variant and means the overall system will also be lighter.

Magnomatics have achieved this by engaging in concurrent electromagnetic thermal materials and digital engineering. There is a strong emphasis on the integrated use of composites. Magnomatics will be developing a range of propulsion motors to meet the broad range of new aircraft being developed for this exciting new market.

David Latimer joined Magnomatics in 2013 in a business development role and became CEO in 2015. Before Magnomatics, Dave was CEO of EVO Electric, a spin-out company from Imperial College. Under Dave’s leadership, EVO gained a strong position in the electric and hybrid vehicle sector, leading to a joint venture with GKN Driveline in 2011. Dave has worked in a range markets including aerospace, automotive, industrial power, water, nuclear and oil & gas.